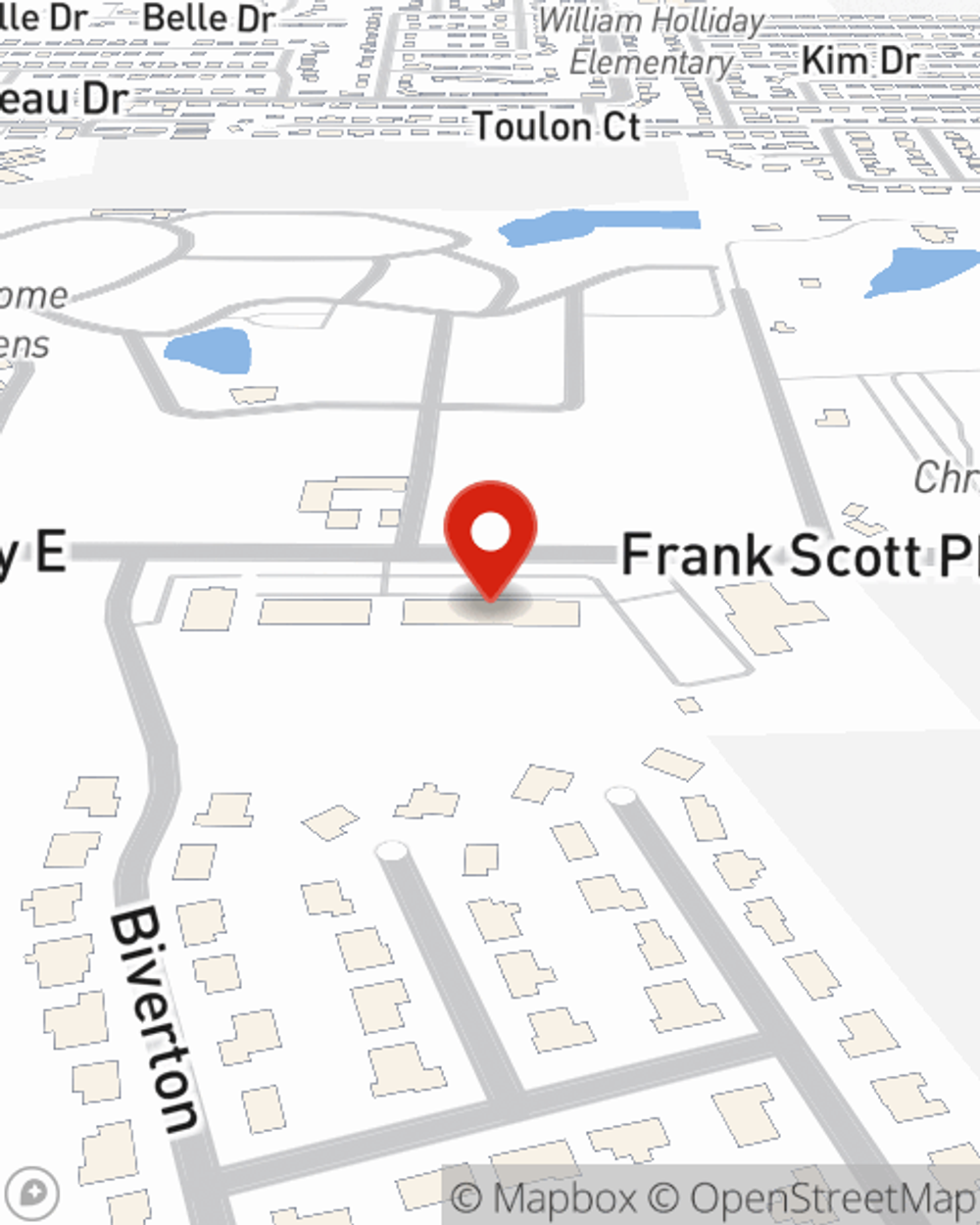

Life Insurance in and around Swansea

Insurance that helps life's moments move on

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

- Swansea

- O'Fallon

- Shiloh

- Belleville

- Millstadt

- Edwardsville

- Fairview Heights

- Maryville

- Troy

- Collinsville

- Smithton

- Mascoutah

- Lebanon

- Scott Air Force Base

- Freeberg

- Caseyville

- Columbia

- Waterloo

- Trenton

- New Baden

- Highland

- Alton

- Granite City

- St. Louis

Your Life Insurance Search Is Over

If you are young and newly married, it's the perfect time to talk with State Farm Agent Keith Wolf about life insurance. That's because once you start building a life, you'll want to be ready if your days are cut short.

Insurance that helps life's moments move on

Now is the right time to think about life insurance

Put Those Worries To Rest

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with coverage for a specific number of years coverage for a specific time frame or another coverage option, State Farm agent Keith Wolf can help you with a policy that's right for you.

No matter what place you're at in life, you're still a person who could need life insurance. Reach out to State Farm agent Keith Wolf's office to determine the options that are right for you and those you hold dear.

Have More Questions About Life Insurance?

Call Keith at (618) 235-WOLF or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Simple Insights®

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.